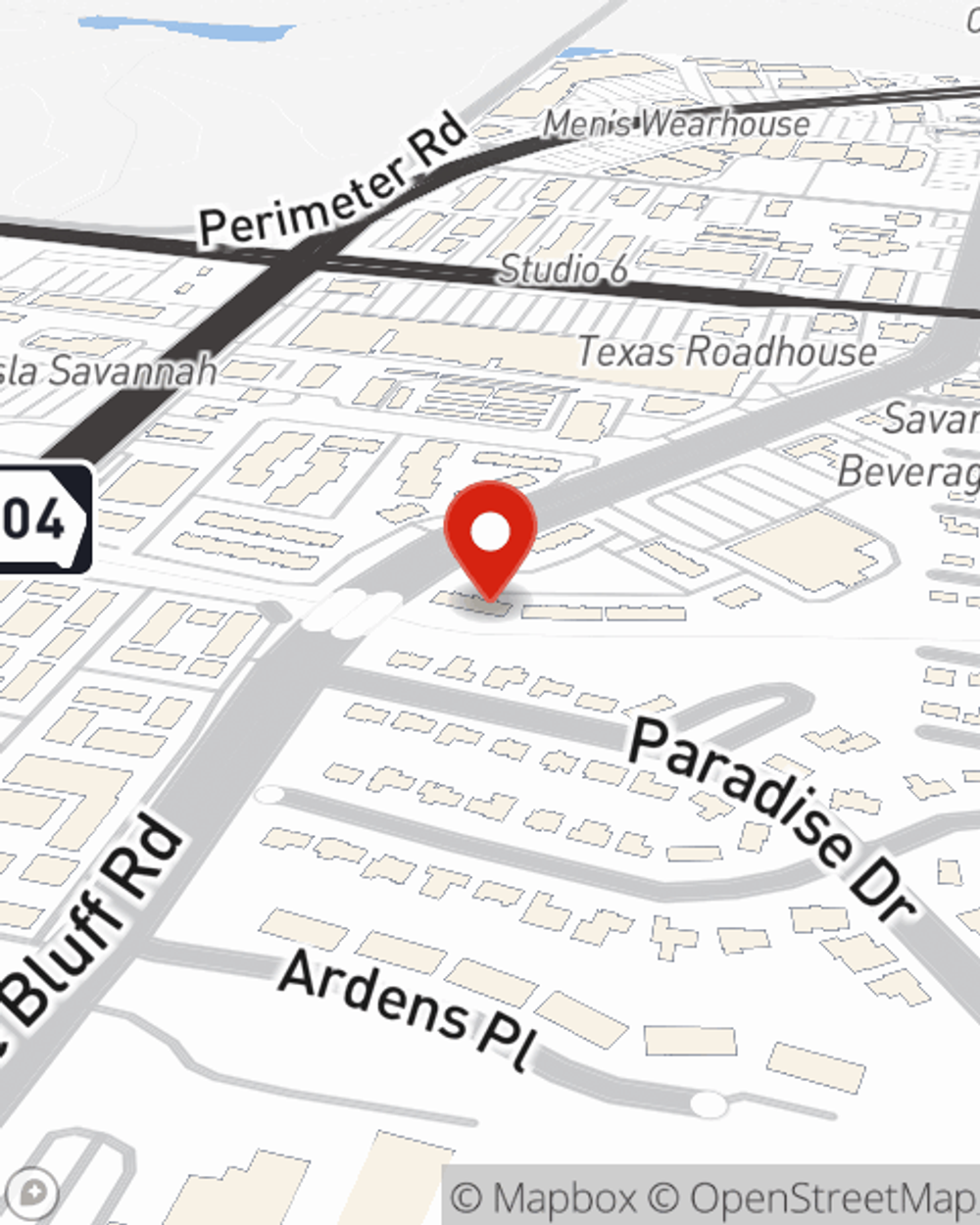

Business Insurance in and around Savannah

One of Savannah’s top choices for small business insurance.

This small business insurance is not risky

- Savannah Quarters

- South Bridge

- Downtown Savannah

- Columbia, SC

- Atlanta, GA

- Summerville, SC

- College Park, GA

- Statesboro, GA

Help Protect Your Business With State Farm.

Owning a business is a 24/7 commitment. You want to make sure your business and everyone connected to it are covered in the event of some unexpected trouble or accident. And you also want to care for any staff and customers who stumble and fall on your property.

One of Savannah’s top choices for small business insurance.

This small business insurance is not risky

Protect Your Future With State Farm

The unexpected is, well, unexpected, but you shouldn't wait until something happens to make sure you're properly prepared. State Farm has a wide range of coverages, like a surety or fidelity bond or extra liability, that can be designed to develop a customized policy to fit your small business's needs. And when the unexpected does happen, agent Sam Sharpe can also help you file your claim.

Do what's right for your business, your employees, and your customers by reaching out to State Farm agent Sam Sharpe today to discover your business insurance options!

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Sam Sharpe

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.